Calculate interest only payments on line of credit

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. With an APR of 899 the cards interest rate is less than half that of the typical 1999 rate found on most credit cards.

Interest Only Loan Calculator For Excel Amortization Schedule Loan Repayment Schedule Excel Templates

If you rely on credit for your everyday spending but need the financial wiggle.

. A measure of the cost of credit expressed as a percent. This is known as the periodic interest rate or daily interest rate. To calculate credit card interest divide your interest rate or APR by 365 for each day of the year.

See Fact Sheet 28K andor call our toll free information and help line available 8 am5 pm in your time zone 1-866-4US-WAGE 1-866-487-9243. Balance Transfer APR. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

Additional Resources Thank you for reading CFIs guide to Interest Expense. Multiply the result times the principal outstanding. So for example if youre making monthly payments divide by 12.

Minimum payment is 2 of the unpaid balance or 4600 whichever is greater. For example if you have a 10000 loan at 10 interest your annual interest payments would total 1000. A Home Equity Line of Credit HELOC allows you the flexibility of making interest-only payments for the first 10 years.

Based on the given information you must calculate the line of credit interest payment for October 2019 assuming this bank uses the average daily balance concept. In this example the credit card uses a 360-day year some cards use 365 terms will vary so the daily percentage rate or DPR is equal to 25 360 or. The MBNA True Line Gold Mastercard is one of the few credit cards to offer a rock-bottom fixed interest rate in the single digits on both purchases and balance transfers.

Used correctly this card from Wells Fargo boasts the longest intro APR on purchases and qualified balance transfers on the market. Divide your interest rate by the number of payments youll make in the year interest rates are expressed annually. 18-months from account opening at 0 percent interest then 1524.

Owning a credit card with a low interest rate can help you save money on APR charges. Enter the interest rate for your credit card balance in column B next to the Interest rate label. Will have to be entered as a monthly interest rate.

How much would those payments be and what impact would choosing to make additional principal payments have on your overall loan balance. As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt. An interest rate is the amount of interest due per period as a proportion of the amount lent deposited or borrowed called the principal sumThe total interest on an amount lent or borrowed depends on the principal sum the interest rate the compounding frequency and the length of time over which it is lent deposited or borrowed.

The interest rate on fixed-rate credit card plans though not explicitly tied to changes in other interest rates can also change over time. But high home prices may make the dream seem out of reach. To make monthly mortgage payments more affordable many lenders offer home loans that allow you to 1 pay only the interest on the loan during the first few years of the loan term or 2 make only a specified minimum payment that could be less than the.

You can calculate it on your own or use an online loan payment calculator or work directly with a loan officer. The interest rate you owe on balances transferred from loans or other credit cards to the applicable credit card. Owning a home is part of the American dream.

These payments are based on a percentage of the total balance making them easy to calculate once you understand how they work. If the same company takes on debt and has an interest cost of 500000 their new EBT will be 500000 with a tax rate of 30 and their taxes payable will now be only 150000. Because the interest rate listed on your credit card statement is an annual rate but this calculation requires the monthly interest amount calculate the interest within the cell by dividing the interest rate by the number of months in a year 12.

Because interest payments on your primary residence are tax-deductible for loans up to 750000 100 percent of your interest-only mortgage is tax-deductible if you itemize. Where loans have a set payment each month that accounts for equity and interest a line of credits payment is different each time. For example if you have an APR of 65 you will create this equation.

Read reviews and recommendations from our experts on the best low interest credit cards available from our. Presuming that you are making interest payments only on a term loan divide the interest rate stated in the loan documents by the number of payments made in a year. The issuer charges the interest to you on a monthly basis taking into account the number of days in each month.

Multiply it by the balance of your loan which for the first payment will be your whole principal amount. Where a corporation has an ownership interest in another corporation. For variable-rate credit card plans the interest rate is explicitly tied to another interest rate.

The credit card APR interest rate is stated on an annual basis but interest is calculated daily using either the exact DPR 365 days or the ordinary DPR 360 days depending on the card issuer. To illustrate the three-step process for calculating your interest charges imagine that you have an outstanding balance of 3500 on a credit card with an interest rate of 25 percent. To learn more about rates terms and exclusive discounts for members such as Commitment Household call 8003588228 or visit any Patelco branch.

There are several ways to calculate your monthly auto loan interest payment. An MMM-Recommended Bonus as of August 2021. An interest-only home equity line of credit HELOC is when you make payments on the interest first for a number of years while you are drawing funds on the credit line.

For most cards you begin with a low rate even 0 for a. Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner. The APR range is 1000 to 1400 for Signature Line of Credit and Overdraft Protection Line of Credit.

Such as piece rate or received other types of payments such as commissions or tips his or her regular rate may. The only variable you will. Heres how it works.

Since there is no fixed formula to calculate interest on the line of credit it depends from bank to bank and here they are charging based on the average daily balance.

Simple Loan Calculator

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Interest Only Home Loan Calculator With Money Saving Idea Interest Only Mortgage Mortgage Payment Mortgage Payment Calculator

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

Heloc Calculator

Is A Balloon Mortgage Really What You Want Loan Calculator Mortgage Loan Pay House Loan Payme Amortization Schedule Free Mortgage Calculator Mortgage Loans

Pin Su Loans Calculator Iphone Application

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Excel Formula Calculate Payment For A Loan Exceljet

Excel Formula Calculate Loan Interest In Given Year Exceljet

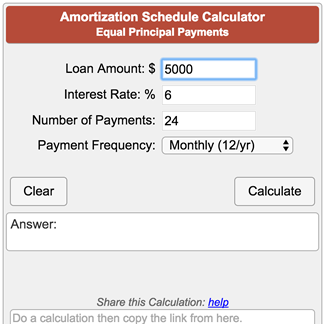

Amortization Schedule Calculator Equal Principal Payments

Advanced Loan Calculator

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

Interest Only Mortgage Calculator

Financial Templates Amortization Schedule Excel Templates Loan Repayment Schedule

Excel Formula Calculate Interest Rate For Loan Exceljet